We recently shared this market update as part of our 1Q2023 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

This quarter’s central story was a banking crisis that reverberated across industries and geographies. The first bank to file for insolvency was the crypto-friendly bank Silvergate, which provided the anti-crypto crowd with the ideal scapegoat to pin the crisis on. Yet when other banks across the US and Europe with less affiliation to crypto also started to fail, it became apparent that the real issue was the failure of central and commercial banks to manage risk effectively.

It is a precarious time for the crypto industry. Particularly in the US, regulators and government agencies are hard at work to smother the industry. Some politicians have even made it a central theme of their re-election campaign. Nevertheless, other jurisdictions are actively seeking to position themselves as the leading hub for crypto worldwide. Hong Kong and Singapore are vying for crypto talent and Europe is on the cusp of formally adopting MiCA, the most sophisticated and far-reaching regulatory framework for crypto in the world.

In the midst of all this, BTC and ETH rose by 72% and 50% respectively, indicating a clear view by the market on what these developments mean for crypto. In addition, on the early stage side we’ve noticed a strong pickup in fundraising activity. It feels everyone just needed 2022 to draw to a close and start 2023 on a clean mental slate.

The net result of this quarter is, in our view, a positive one for the industry. Crypto is clearly at the top of the political agenda. Politicians are leveraging it as an issue to win elections. Other countries are competing to attract talent. In the short term it is difficult to predict what will exactly happen, although it’s clear that the road will be bumpy. In the long-term, this quarter has shown once again why crypto matters, and that it is here to stay.

Banking crisis

While the full spectrum of the banking crisis was far reaching, it had particularly acute repercussions for the crypto industry with three crypto-friendly banking partners going out of business.

During the era of near zero interest rates, banks experienced a surge in deposits as customers had more money to save than ever before. To achieve a meaningful return on these deposits, banks had to assume greater duration risk by investing in longer-dated bonds. However, when the Federal Reserve began raising interest rates, the prices of these bonds fell, causing some banks to have a fair liquid asset value that was lower than their deposits. Banks could hide this fact through an accounting trick that did not require them to mark their long dated bonds to market. Nevertheless, if these banks were compelled to sell the bonds—for instance, to process customer withdrawals—they would incur losses that could trigger a loss of confidence by customers who would now worry about the safety of their deposits. This is exactly what happened.

Silvergate was the first of a series of banks to experience a bank run. Silvergate was founded in 1988 and in 2016 decided to focus on serving the crypto industry. It had a wide ranging customer base across the industry including FTX. In the aftermath of the FTX meltdown, depositors lost confidence in the bank due to its ties to the company and began initiating withdrawals. This started at the end of last year but gained momentum at the beginning of this year. Silvergate was forced to liquidate its bond portfolio to process withdrawals but its market value was too low to cover all withdrawals. As a result, the bank ultimately filed for bankruptcy protection.

Shortly thereafter, the premier banking institution for the entire technology industry in the US, Silicon Valley Bank (SVB), also filed for bankruptcy. While the spark of the run was different, a failed rights issue, the sequence of events was the same: SVB experienced mass withdrawals, began liquidating its long-dated bond portfolio, and ultimately failed to service all customer withdrawals. After a weekend of uncertainty as to whether the US government would step in to protect customer deposits, the FDIC on that Sunday announced all depositors would be made whole.

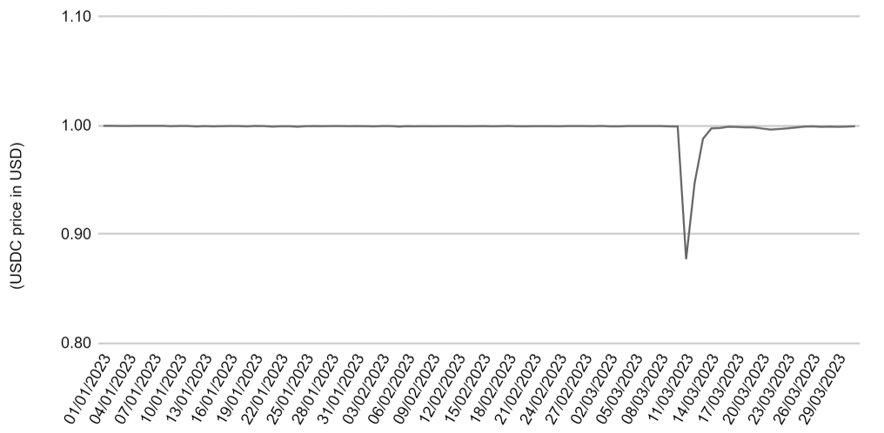

Over that same weekend, a mini-crisis unfolded in the crypto world when it became clear that Circle, the company behind the USDC stablecoin, held $3.3B out of its $40B in deposits with SVB. USDC is a dollar denominated stablecoin that is backed 1:1 with USD. With approximately 8% of deposits at risk, USDC holders were worried that their tokens were not fully collateralized anymore and started aggressively selling. At one point there was so much sell pressure that the price of USDC fell to $0.87. When the FDIC stepped in to protect all deposits, the panic stopped and USDC recovered to its $1 peg.

Closing out that eventful weekend, the FDIC on that Sunday took over Signature Bank preemptively ahead of any bankruptcy proceedings. Signature Bank was founded in 2001 and in 2018 opened itself to the crypto industry. The move to shutter Signature Bank was justified as a proactive measure to protect consumer deposits but was seen by others as a deliberate move that took advantage of the banking crisis to further reduce crypto’s access to the traditional banking sector.

For the crypto industry this sequence of events was a massive blow. In a single quarter, the industry lost valuable banking partners, particularly in Silvergate and Signature Bank. Finding banking partners as a crypto startup was already hard before and is now even harder. While the failure of some of these banks can be accredited to poor risk management practices, there is word of something more sinister bubbling under the surface.

Politics and crypto

Running parallel to the banking crisis was, and still is, a coordinated effort by US regulators and government agencies to smother the crypto industry. This is being done in two primary ways.

The first is an attempt to cut off crypto companies from the banking sector. Not unexpectedly, the collapse of FTX has provided people in government with the ideal opportunity to strike against crypto. Instead of creating policy through lawmaking, the approach taken by officials is one of behind-the-scenes coercion. Over the past couple of months there have been reports of officials pressuring financial institutions to stop servicing the crypto sector and the sale of Signature Bank after its bankruptcy was reportedly conditioned on the closure of its crypto business. This effort is aptly named Operation Choke Point 2.0 and is detailed in a fantastic post here. Operation Choke Point 2.0 is a reference to Operation Choke Point, which was a similar attempt by regulators to bypass Congress in order to shut off entire industries from the banking sector.

The second strategy is to conduct regulation by enforcement, which is when regulators attempt to encourage compliance through actions such as fines or penalties, rather than by providing clear guidance or rules that can be followed. Despite the SEC’s plea for crypto companies to “come in and talk to us,” it’s clear the SEC, especially under this administration, has no intention of embodying a collaborative attitude. Nothing makes this as clear as the SEC issuing Coinbase a Wells Notice, an advanced statement by the SEC that they intend to sue. The SEC claims that Coinbase’s staking product is a security offered to customers without the required registration. The thing to note is that when Coinbase underwent the process of going public two years ago, a process overseen by the SEC, the staking product was already part of the business. Yet the SEC gave Coinbase permission to go public without requiring any changes to its staking business. Additionally, over the following years, Coinbase repeatedly attempted to engage with the SEC about practical industry-wide regulation, only to be stone-walled and ultimately sent the Wells Notice.

Ultimately, it’s all politics. Some government officials have made it their personal ambition to etch their name in history by fashioning themselves as the anti-crypto strong(wo)man. What is somewhat amusing is that this power struggle has seen in-fighting between the regulators themselves. For example the SEC believes all tokens with the exception of Bitcoin to be securities and therefore under their jurisdiction while the CFTC maintains that ETH is not a security but a commodity under their supervision.

Whatever one’s position on crypto, it should be disturbing that in a democratic country like the US, a few unelected officials are choosing to strike down an industry unilaterally on their own terms.

Yet, while the US continues to marginalise crypto and jeopardise its position as a leader in the industry, other jurisdictions have begun to seize the initiative. Hong Kong has taken a friendlier tone to crypto and is luring away talent from its local rival Singapore, the UAE has talked about creating a “crypto oasis” and Rishi Sunak in the UK appears to be crypto friendly.

Our hope is that the EU also steps up to the plate. With MiCA becoming formalised this April, we believe it has a good shot.

Protocols booking earnings

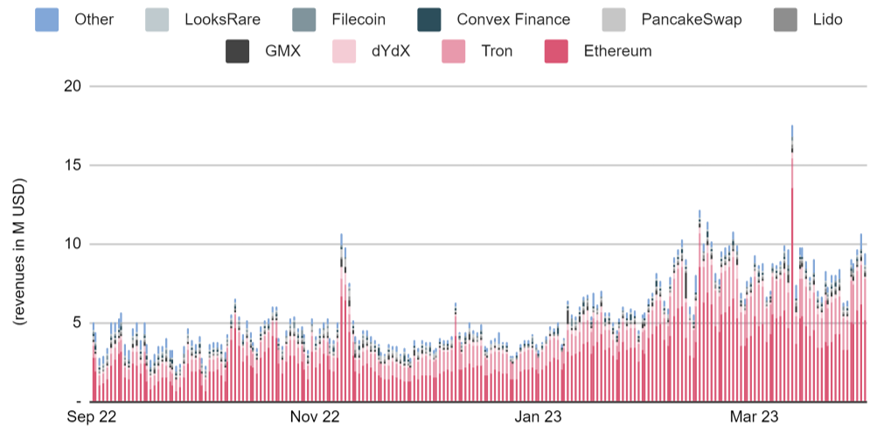

A sign of the increasing maturation in the space can be indexed by the growing number of on-chain applications, and the organisations behind them, that have been able to book earnings net of any token inflation or other incentive schemes (and before operational costs).

Since the inception of DeFi, protocols such as Uniswap and Compound have been charging fees but with either a non-existent or tiny take rate going back to either the protocol’s own treasury or to holders of their token. Additionally, most protocols have relied on their token supply to incentivize users, comparable to customer acquisition costs in traditional businesses. However, as with the broader market in 2022, many new and old projects were forced to face reality and position their fundamental economics towards true profitability.

Token Terminal now counts over 25 protocols and on-chain applications that are projecting earnings run rates above $1m/year using their last 30 days’ performance. GMX and Lido are the most profitable and on pace in 2023 to do $50m and $40m in earnings respectively, all of which will be kept in either their DAOs’ treasuries or returned back to token holders after deducting operational costs.

Developments in the base layers

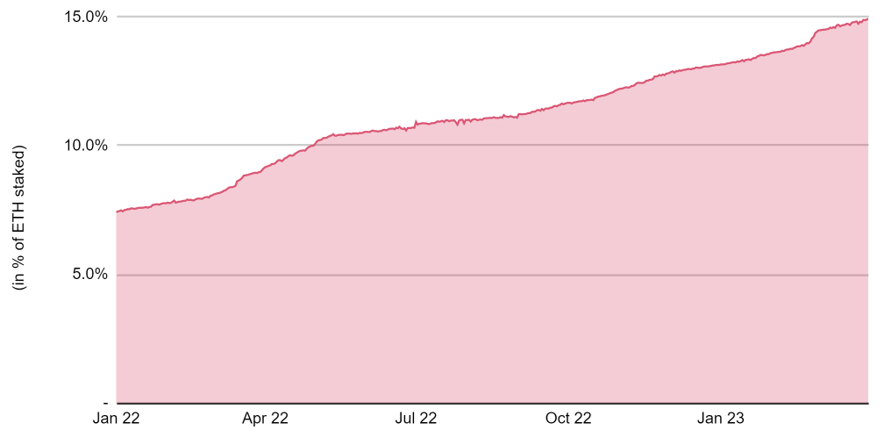

We continue to observe in very real terms Ethereum’s dominant foothold as crypto’s premier application platform. As a continuation from last quarter’s update, Ethereum has now completed its architectural transformation into a proof of stake (PoS) network, solidified its lead as the de-facto security layer for rollups, and begun to see its scalability thesis play out.

The Ethereum network activated its latest update, named “Shapella”, on the evening of April 12 (UTC). Amongst a few minor upgrades to the EVM instruction set, the predominant upgrade this time was to finally enable withdrawals for stakers who validate Ethereum’s consensus layer. This completes Ethereum’s long-awaited transition to PoS, which was kicked off by the launch of the Beacon chain in Dec. 2020 and advanced last September by the “Merge” upgrade. We’ll have more to report on in next quarter’s update as we observe how the community responds to withdrawals and which opportunities are uncovered by enterprising protocols and entrepreneurs.

In line with Ethereum’s larger roadmap to enable and secure higher-level and more efficient networks—primarily classified as rollups—the last quarter saw Coinbase commit to an on-chain strategy tethered to Ethereum’s own vision. Coinbase’s new network, Base, is an optimistic Layer 2 (L2) rollup built from open-source infrastructure that will rely on Ethereum for its security. Across the ecosystem, we observe every notable L2 network thus far as having chosen Ethereum for their security layer.

The final point of note for the last quarter is the consistently strong adoption of Ethereum-based L2s, with Arbitrum earning a wide margin as the current leader. Combined, daily transaction volumes across Arbitrum and Optimism have steadily overtaken Ethereum’s own transaction volume to land at a 60:40 ratio in their favour. DEX volumes, a good indicator of valuable protocol usage, shows Arbitrum trending sharply upwards to now serving 20% of Ethereum’s own DEX volumes (in March: $18b for Arbitrum and $90b for Ethereum) and overtaking Binance Smart Chain (BSC) for the second-highest volume network (in March: $18b for Arbitrum and $10b for BSC). It’s worth noting BSC has not been dethroned from its second-place position since all the way back to Dec. 2020.

The quarter in 3 charts

Graph I - USDC depegging

Before the FDIC stepped in to protect all deposits with SVB, the $3.3B Circle had lying in SVB accounts was at risk. Massive sell pressure out of USDC ensued out of fear that USDC was no longer fully collateralized by USD deposits, bringing the price of USDC to a low of $0.87. The peg was, however, quickly restored once the FDIC guaranteed all deposits.

Graph II - Decentralised protocols generating revenue

Decentralised protocols are demonstrating their ability to generate serious revenues and dispelling the notion that they cannot accrue value.

Graph III - ETH staking participation

Since inception in Dec. 2020, Ethereum’s staking participation has continually risen with over 18 million ETH—around 15% of total ETH supply—now bonded as deposits to provide security on behalf of the network. Sustained efforts from all fronts, such as advancements in infrastructural tooling, increasing operator professionalism, and the adoption of liquid staking platforms have helped to expand the addressable market for staking yield.