We recently shared this market update as part of our 2Q2024 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

In our previous update, we noted that the industry had become excessively bullish. This quarter, we observed a slowdown in the frenzy that began late last year and persisted through the first quarter of this year. Over the past three months, the total market capitalization of all crypto assets decreased by 12%, with BTC and ETH declining by 15% and 8% respectively.

We have also seen certain segments of the industry change their outlook from one of extreme optimism to pessimism. Such fluctuations are not unusual in this industry. For those who focus solely on public market prices, their sentiment reflects the volatility of crypto price charts.

However, for those who know where to look, crypto has never been in a stronger position. This past quarter, several developments emerged that we believe provide a more accurate picture than price movements alone and we are excited for the months ahead.

Institutional warming

Institutional adoption of crypto is accelerating. Following the launch of the first Bitcoin spot ETF last quarter, this quarter saw the approval of the initial batch of ETH spot ETFs. Sponsors include BlackRock, Fidelity, Invesco, and Ark Invest, with trading expected to launch imminently.

Relatedly, crypto has become a significant topic in mainstream political discourse. This trend has been developing over the last year but became particularly evident this past quarter when former President Donald Trump announced his pro-crypto stance. Democrats reacted by verbally softening their previously hawkish position. While we have yet to see this rhetoric translate into policy, politicians from both parties discussing crypto marks a significant shift from the political atmosphere just a year ago.

Consumer apps

Tied closely to the current political cycle is Polymarket, an Ethereum-based prediction market. It is one of the consumer apps in crypto that managed to break into the mainstream this year and has quickly become the global benchmark for live odds on events as important as the US Presidential election. Users on Polymarket have wagered more than $260m on the event.

Prediction markets are markets which allow users to trade on the outcomes of real-world events, including political elections, sports events, and other current events. By aggregating public opinion and knowledge into a market price that reflects the probability of an event, they not only allow individuals to express their beliefs with skin in the game but also act as a market driven tool for determining the likelihood of the future outcomes. Polymarket was built on Ethereum to be decentralised, empowering users to create their own markets.

Separate from crypto-native consumer experiences, we continue to see positive developments from the traditional fintech front. Robinhood recently acquired the EU-based crypto exchange Bitstamp for $200m to further bolster its rapidly growing crypto business. The company’s cryptocurrency revenue surged 232% year-on-year to $126m in the first quarter, making it the firm’s largest business line.

Over the past few months we’ve been spending a considerable amount of our time looking at opportunities in consumer crypto. We believe the infrastructure to support mainstream crypto consumer applications is already in place and that we just need more efforts to develop them.

DeFi is maturing

DeFi remains one of the primary use cases for crypto and continues to attract significant entrepreneurial energy and funding. What we’re now witnessing is the transformation of DeFi from a novel technology into a maturing industry. There are several indications that convey this.

First, DeFi protocols are starting to generate substantial revenues. In the first two quarters of this year alone, three major DeFi protocols—Lido, Maker, and Aave—respectively produced $55m, $161m and $30m in revenue. Compared to the same period last year, this represents a 96% revenue growth for Lido, 762% for Maker, and a 424% increase for Aave.

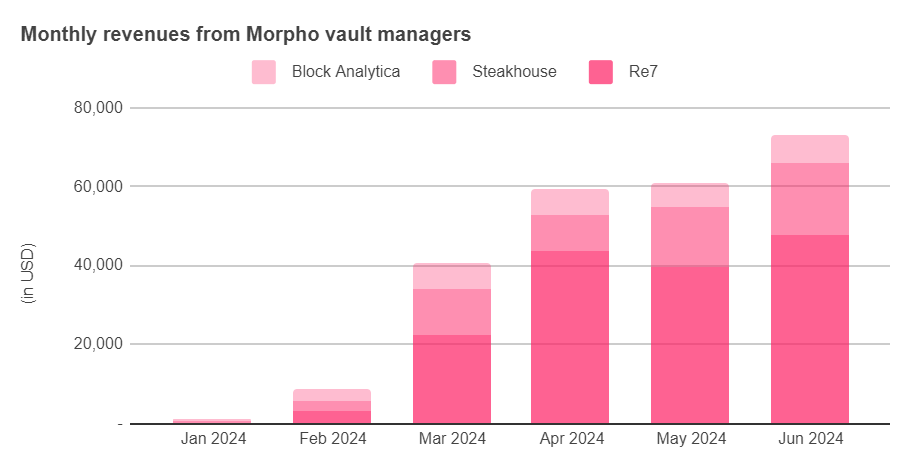

We now also have protocols such as Morpho that provide a platform for third parties to establish real businesses on top. For instance, individual vault managers like Re7, who develop lending strategies on Morpho Blue, are already generating over half a million dollars in annualised revenue.

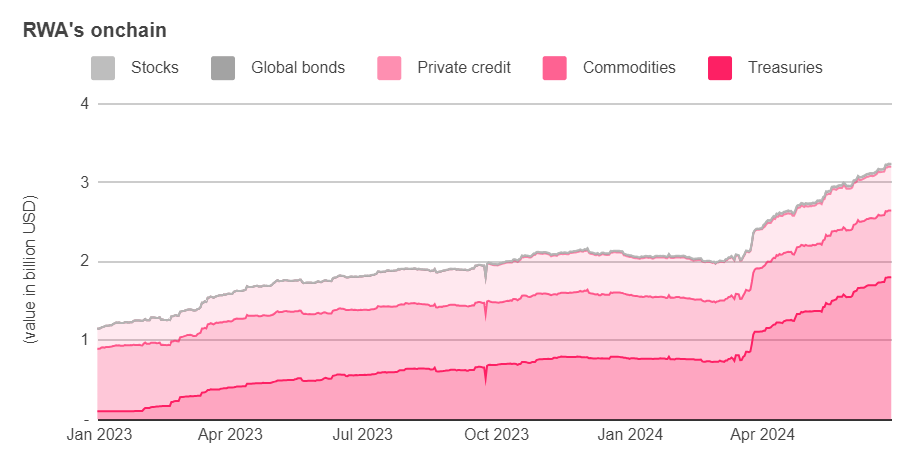

Secondly, on the asset side, there are now over $3bn in tokenized real world assets such as T-Bills, private credit, commodities and stocks that have been brought on-chain. This represents an 80% increase from $1.8bn just one year ago. If we include fiat-backed stablecoins such as USDC, we are now at over $165bn in tokenized real world assets.

This not only provides on-chain capital with easy access to a wider range of assets, but also allows it to hedge against the risk associated with native crypto assets. For instance, throughout most of 2022 and 2023, DeFi rates were lower than US treasury rates, but on-chain capital couldn’t access T-Bills without off-ramping funds. Now, with tokenized T-Bills, investors can benefit from T-Bills without leaving crypto.

Revenue-generating protocols and the expansion of available on-chain tools for investors are necessary components of a maturing industry.

The quarter in 3 charts

Polymarket hits record highs

Polymarket has been a break-out crypto application this year. Users have placed $590m in its markets thus far, with the US Presidential Election accounting for $260m in sitting bets. In June 2024 alone, the platform saw 35k active users place bets.

Growing supply of RWAs

Real world asset protocols have experienced significant growth throughout the year, highlighting the increasing accessibility for low-risk, yield generating assets on-chain. Combined, there are now over $3bn in tokenized RWAs, excluding stablecoins.

Morpho Blue empowering third parties to build businesses

Morpho Blue has established itself as a key provider of lending infrastructure in DeFi. With over $1.7bn in TVL, vault managers are starting to demonstrate their ability to build attractive businesses on its platform by earning over $70k per month in revenues.