We recently shared this market update as part of our 3Q2023 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

On the surface, this quarter felt very much like a continuation of the last—quiet and unassuming in relation to some of the preceding periods. Yet under the hood we’re seeing a series of positive developments start to bubble up.

After months of conducting its onslaught against the crypto industry in the US, the SEC suffered two notable setbacks in court. One of the rulings is likely to force the SEC’s hand in approving the launch of the long-awaited Bitcoin ETF, which has the potential to considerably expand crypto’s institutional investor base. While there are still plenty of regulatory challenges ahead, it’s encouraging to see the SEC’s destructive efforts face pushback from the US’ judicial system.

On the product side we’re seeing a maturation of infrastructure that we believe will catalyse the next wave of end user applications. We’re already seeing signs of this play out within our portfolio, and we’ve been focusing our efforts over the past months on finding new investment opportunities at the application layer. There’s still a lot of infrastructure that needs to be built, but applications are what will propel the space forward and where we think the best investment opportunities currently lie.

SEC suffering setback in court

In our previous updates this year we’ve discussed the various ways the SEC is attempting to suffocate crypto in the US. This quarter saw more positive developments in that regard as the SEC suffered two notable setbacks in court.

At the beginning of July, a court ruled that Ripple Labs, the development company behind the Ripple network, didn’t violate investor protection laws when it sold Ripple’s native token, XRP, on exchanges. The SEC’s claim was that XRP is a security and as such all of Ripple Labs’ sales of XRP tokens constituted illegal securities offerings. The court concluded, however, that the sale of XRP tokens conducted on exchanges, amounting to roughly half of the total, didn’t constitute an illegal securities offering as buyers could not have known that Ripple was the seller and as a result were not relying on Ripple’s efforts to drive the value of XRP. The court agreed that the other half of XRP sales conducted directly with investors and not with exchanges did constitute an illegal securities offering.

While the ruling was a big win for Ripple, the most important aspect is the potential it has to shape case law that would undermine the SEC’s ongoing suits against exchanges like Coinbase and Binance. If this ruling were to be applied to other cases, it could make it much more difficult to claim that tokens sold through exchanges had constituted a securities offering.

A couple of weeks later another court ruled that the SEC must reconsider Grayscale’s application to launch the first Bitcoin spot ETF. The court ruled that ““the denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products.” This ruling could significantly accelerate the launch of the first Bitcoin spot ETF, with growing optimism that it could happen in just a matter of months.

Our takeaway from these two rulings is that it’s heartening to see the judicial system serve as a counterweight to the SEC’s continued overreach.

Maturing infrastructure enabling applications

For the past couple of months we’ve been excited by opportunities at the application layer. We’ve previously shared some of our thoughts around this here.

The way we see it, developments in infrastructure and applications occur in reinforcing cycles. More infrastructure enables more applications, which then call for more infrastructure and the cycle repeats. In our view we’re reaching the maturation stage of the latest cycle of infrastructure development, which can now power a host of new applications.

Advances in layer 2 scaling technologies, embedded wallet solutions and other pillars of infrastructure have given founders the tools to build experiences that leverage the benefits of crypto while hiding the complexity. The output is products people use because they offer something unique and compelling, without necessarily needing to know that blockchains are powering that experience.

We’ve been seeing some early signs of this playing out within our portfolio.

In August, Courtyard upgraded its product by abstracting away much of the crypto wiring. Users can now create a wallet directly on Courtyard without needing to download a browser extension like Metamask or learn what a seed phrase is. Buyers can purchase NFTs with a credit card and sellers don’t need to pay gas fees when listing their assets on the marketplace. Courtyard is not positioning itself as a platform for physically-backed NFTs, but rather as a platform that turbocharges the digital card collecting experience. The results have been clear: August sales volume on the marketplace was $21k and in September it grew to $221k.

HairDAO is harnessing the power of its community through its DAO structure to drive hair loss research forward and bring new drugs to market. The first study funded by HairDAO examined the topical use of two FDA-approved drugs, T3 and T4, traditionally used for hypothyroidism, as potential solutions for hair loss. Encouraging preliminary findings have paved the way for repurposing T3/4 into a spray to combat hair loss, which will undergo trials conducted by doctors in Miami. Members of the HairDAO community were among the first to volunteer as trial participants.

In both cases, crypto is the infrastructure that enables the experience. It is the means to an end, not the end in itself. People come to Courtyard because they want a fun digital card collecting experience and people join the HairDAO community because they personally want to have access to better hairloss treatments. NFTs, DAOs and crypto wallets simply enable these new experiences.

The quarter in 3 charts

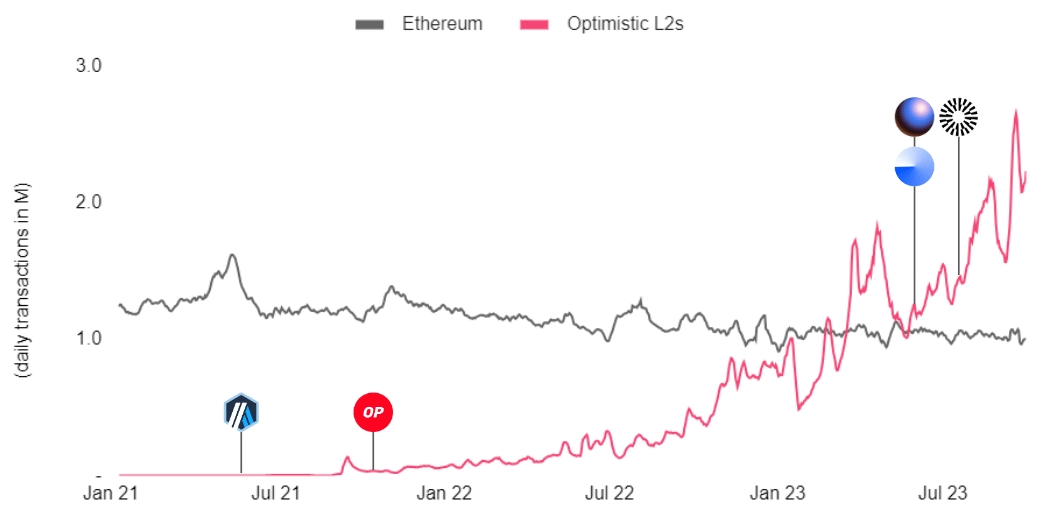

L2s continue their sharp rise

Layer-2 Ethereum scaling solutions are processing transactions at an accelerating rate. The average number of daily transactions grew from 1.3m in June to 2.0m in September, constituting a 55% increase. Coinbase launched its own L2 called Base in August, which has seen strong early traction, with further proliferation of app or ecosystem specific L2s expected given the maturation and commoditization of the underlying infrastructure powering L2s. Cheaper and faster transactions provided by scaling solutions is one of the required pillars to scale crypto beyond its current audience.

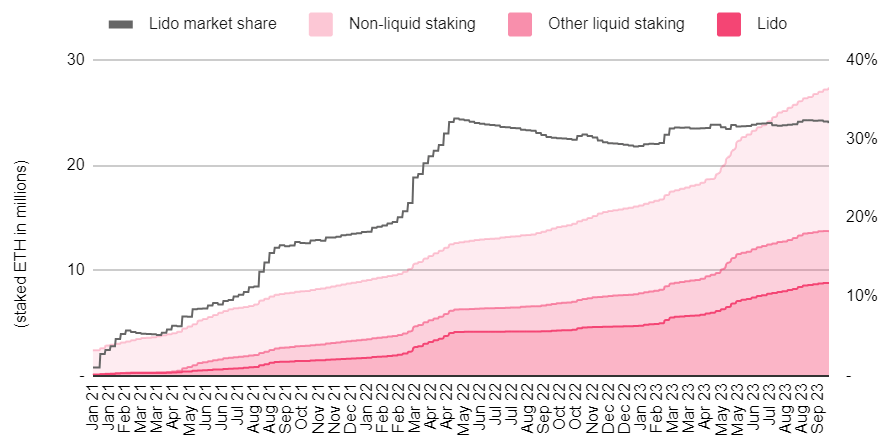

Lido has established itself as the category winner in ETH staking

Ethereum staking has seen substantial growth to over 27 million ETH now being staked, making up 23% of the total ETH supply. Lido has established itself as the category winner, capturing a 32% market share. The project has now set a self-imposed cap on its growth as exceeding 33% would give Lido the ability to impact block confirmation times. Any further growth in market share for Lido is therefore dependent on its upcoming decentralisation initiatives.

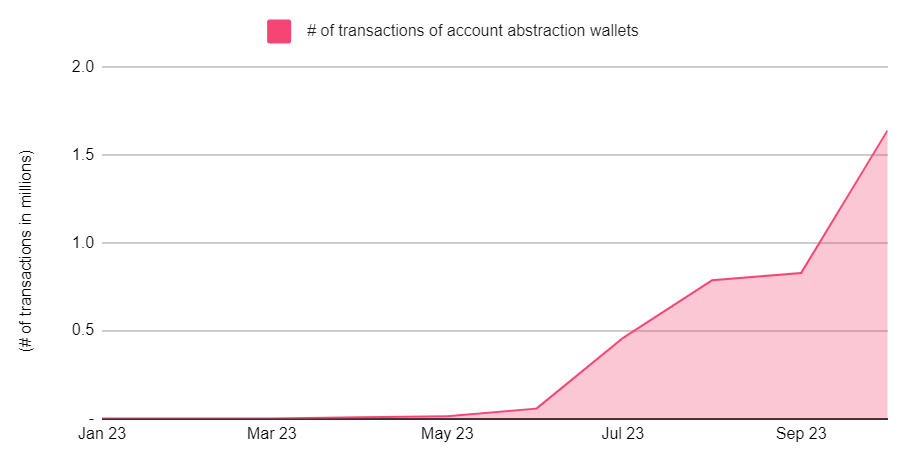

Account abstraction wallets (ERC-4337) finding early adopters

A new generation of wallets, along with their supporting infrastructure, are finding their first adopters after a year of development. These promise to significantly enhance the user experience by helping abstract blockchain complexities while still being non-custodial. Although distribution is early with only a few apps integrated, we see a lot of potential in the unique experiences that apps will soon be able to offer by building atop this new wallet infrastructure.