We recently shared this market update as part of our 4Q2024 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

When we launched the fund 3 years ago in early 2022, crypto was at the tail end of a bull run. However, just a few months later, the industry was confronted with a series of endogenous problems that culminated in the collapse of FTX. While many jumped to early conclusions of crypto’s fall into irrelevance, the situation on the ground has always been a different story. Proven time and time again, crypto continues to show that resilience is one of its core strengths.

We currently find ourselves in a moment that could not be more different to the darkest of hours of these past 3 years. The underlying metrics of crypto adoption have never been stronger, the technology has never been more mature, and with the election of President Trump, crypto will finally receive the political support it has so desperately lacked all these years.

We have never been more excited about crypto’s potential, and look forward to the next years of investing in the industry’s next stage of growth.

Politics

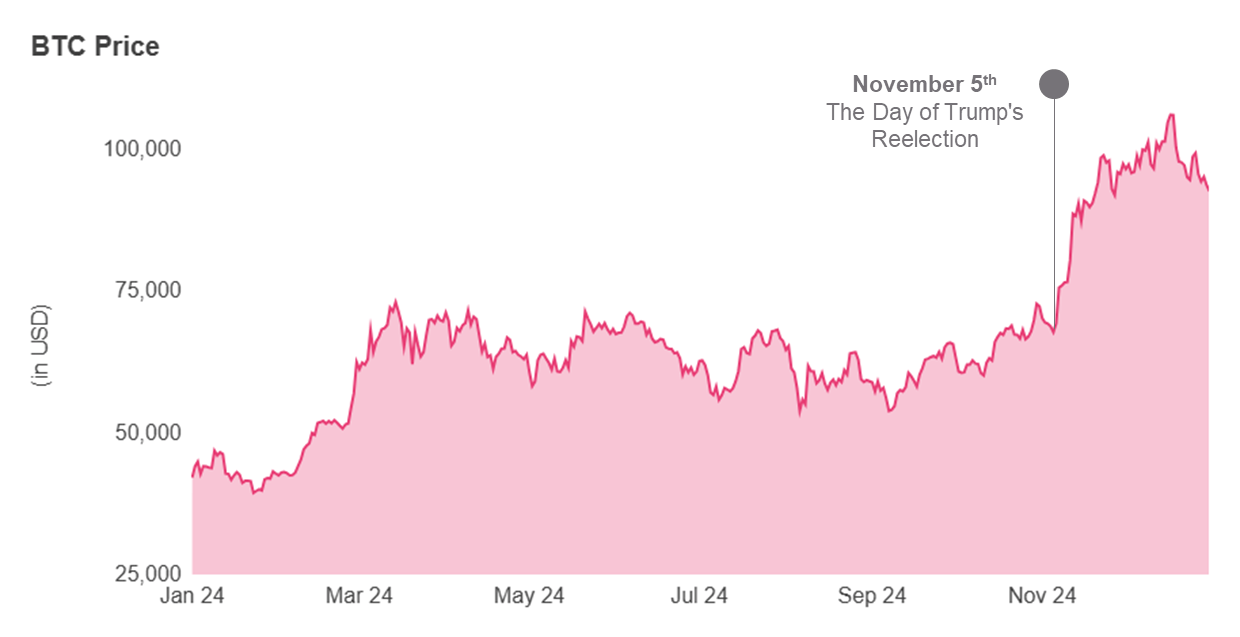

Donald Trump secured a second term as US President after winning the election in November. The significant price surge in public crypto markets clearly showed how investors viewed the result.

After four years of intense regulatory pressure in the US, marked by lawsuits against legitimate companies and a coordinated effort by various government agencies to sever the sector’s ties with the banking industry, the change in leadership is seen as a highly anticipated and welcome development for the industry.

On the campaign trail, Trump highlighted his crypto-friendly stance by proposing regulatory clarity, the creation of a strategic Bitcoin reserve, revising crypto tax policies and his intention to make the US a crypto innovation hub. He also pledged to replace SEC Chair Gary Gensler with a crypto-friendly appointee. Following his election win, Trump appointed David Sacks, a known crypto supporter, founder of Craft Ventures, and host of All-In Podcast, as the “AI and Crypto Czar.” Only time will tell just how much of Trump’s campaign rhetoric will translate into concrete action during his presidency. However, it is safe to say that it will be tough to be less crypto friendly than the outgoing administration. The world often looks to the US for guidance on policy regarding emerging technologies. The hope is that the crypto friendly posturing by Trump turns to reality, which then inspires other Western countries to follow suit.

Finally, worth noting again as a topic we touched on in previous updates, is the role that Polymarket played during the election cycle. Polymarket’s odds often diverged from traditional polls, at times favoring Trump when mainstream surveys did not. This divergence was notable in early October 2024 when Polymarket showed a spike in the odds of Trump’s victory in contrast with other prediction platforms and pollsters. The platform’s predictive accuracy and real-time updates provided an alternative lens through which observers could assess the election’s dynamics, highlighting the growing influence of decentralized prediction markets in political forecasting.

Stablecoins

In October, Stripe acquired stablecoin infrastructure business Bridge for $1.1bn.

Bridge is an API platform that enables developers to integrate stablecoins into their products. Through its API, applications can support multiple stablecoins, facilitate transfers across various networks, and integrate stablecoins into existing financial workflows.

Shortly before its acquisition, Bridge completed a $58m Series B financing round and reportedly reached an annual revenue ranging between $10m and $15m. While the $1.1bn acquisition represents a substantial premium on revenue, it highlights just how strategically important Stripe views stablecoins going forward.

It is becoming more clear to companies operating outside of crypto that stablecoins represent a significant improvement over traditional payment systems by enabling programmable, global, and instant transactions that eliminate many of the inefficiencies associated with legacy infrastructure. Much like the internet revolutionized communication and commerce, stablecoins have the potential to become the foundation of a faster, more efficient financial ecosystem.

(Decentralised) AI Agents

Autonomous agents powered by large language models have captured everyone’s attention, both inside and outside of crypto. Decentralised agents differ to centralised ones in that they are built on blockchains. These types of agents can easily setup crypto wallets, acting as their native bank account, as well as programmatically interact with other applications built on blockchains.

The technology stack underpinning decentralised agents is developing rapidly in real time and we recently outlined some of our thinking in a post. The medium through which users interact with these agents today is text based, including within the feed of social platforms like X and Farcaster.

In their current form, there’s a host of different types of agents including but not limited to:

- Personalities (Aethernet, Luna) - agents living within a social feed, focused on entertainment and acting like regular users by posting, commenting, and engaging.

- Assistants (Gina, Bankr) - agents who respond to prompts by users to answer questions, surface data, and provide help.

- Analysts (aixbt, kwantxbt) - utility-focused agents who consume information and offer analytical insights, e.g., trending projects (aixbt) or technical analysis (kwantxbt).

- Investors (ai16z) - capital-managing agents like ai16z, which make autonomous investment decisions and may factor in information such as community recommendations.

In their current form, calling them agents is more aspirational than accurate. They are LLMs with limited autonomy, still reliant on developer control for decision-making and goal pursuit.

In our view, the long term trend is very exciting but in the short term the technology is still very immature with people chasing short term profits. Many development teams have opted early on to launch a token that represents ownership in their agent. As with other categories in crypto, we think that in most cases early token launches are an indication that the team behind them are optimising for the wrong things and we will continue looking for teams who maximise their chances of building a compelling project for the long term.

The quarter in 3 charts

BTC rallying past $100k following Trump’s election

The reelection of Donald Trump sparked a sharp surge in BTC’s price, breaking the $100k mark for the first time. The anticipation of more crypto-friendly regulations fueled record inflows into Bitcoin ETFs, with the BlackRock Bitcoin ETF now surpassing the size of the BlackRock Gold ETF.

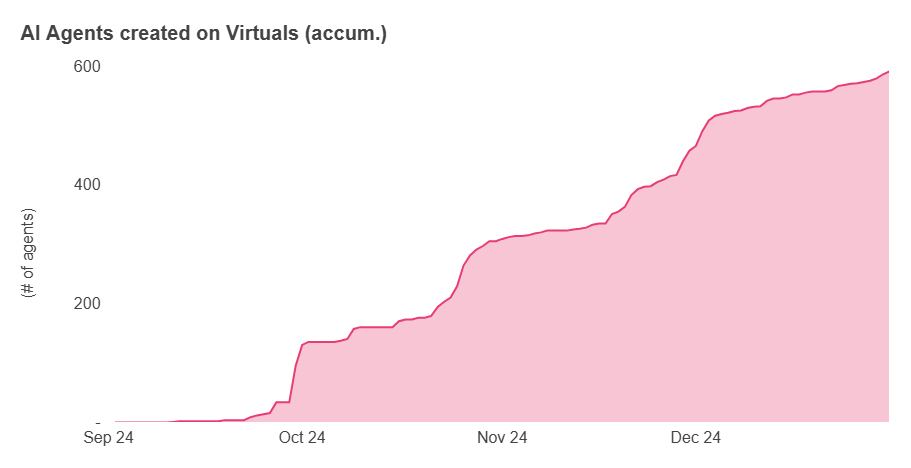

Onchain AI agents gaining traction

Virtuals, one of the leading launchpads for onchain agents, saw a massive uptick in agents launched on the platform. Onchain AI agents as a technology are still immature, but the level of excitement and development activity propelling them forward is high.

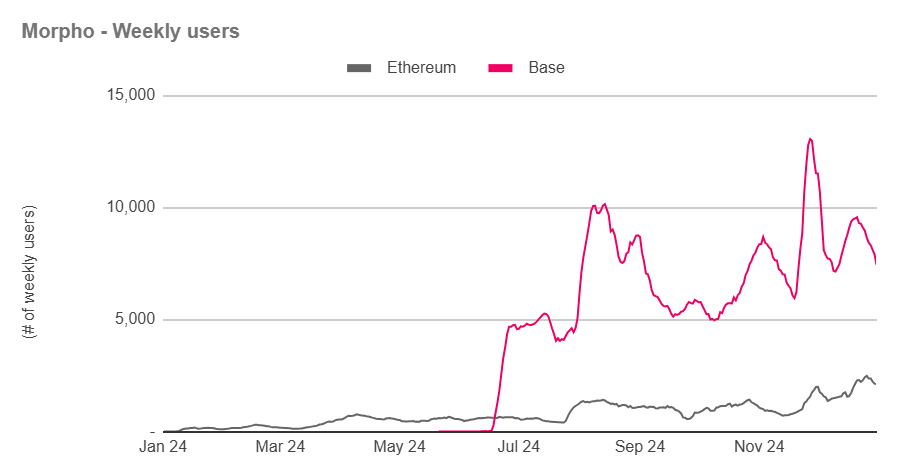

Base driving Morpho’s user growth and activity

The development of user traction on Morpho is a microcosm of the relationship between Ethereum and its L2s, such as Base. Morpho’s instance on Base, despite launching months later than on Ethereum, already has far more active users. Base’s fast user experience and low fees promise to bring mass adoption to Ethereum and crypto more broadly.